France signs off €7.5bn chip factory

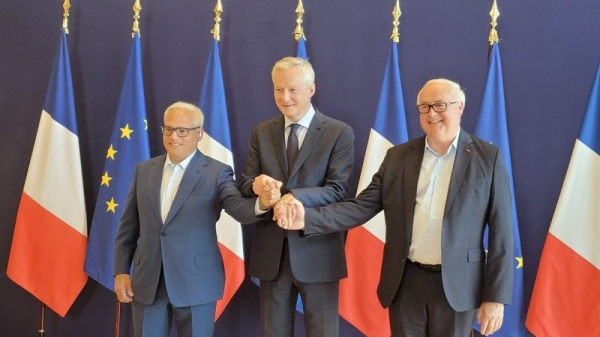

French Economy Minister Bruno Le Maire signed an agreement to set up a new semiconductor factory in France with STMicroelectronics and GlobalFoundries CEOs, supported by €2.9 billion of public money.

As demand for semiconductors – a crucial element of all electronic devices – increases, global players such as the United States, China and the EU have heavily subsidised their domestic manufacturing capacity in an effort to reduce supply chain dependencies.

Le Maire stated that the deal, signed on Monday (5 June), guaranteed that the French state can potentially seize “5% of the industrial production of the factory for French manufacturers only” if France were to face a supply chain disruption.

The economy minister stated that this measure was in accordance with the “de-risking objective” that France had over geopolitical instability.

Content of the agreement

CEO of GlobalFoundries, Thomas Caulfield, called the agreement a “partnership” with the French State.

There is a “harsh” competition worldwide, said Caulfield, at the same time as a subsidy race – the USA alone allocated $52 billion in public subsidies for semiconductor production only.

The French subsidy of €2.9 billion amounts to almost 40% of the project’s total cost. The subsidy should help the two manufacturers to attain double their production by 2030, be more energy-efficient and develop cutting-edge technology.

According to Le Maire, the technology chosen for this factory should reduce the water consumption of the industrial process by 60%. Caulfield added that the technology used would use 130 MW less than comparable factories.

Le Maire said he aims for France to become the “first nation in the world” to achieve thinner engravings, to the order of ten nanometres – with 40 being the current norm. Jean-Marc Chéry, CEO of STMicroelectronics, explained that with this level of thinness, semiconductors can address all future market demands.

Subsidy race

Last February, Intel, a US semiconductor manufacturer, asked the government of Germany to increase the already-agreed state aid funding for building two mega fabs, state-of-the-art microchip factories, in Magdeburg.

The request was justified based on rising energy and raw materials costs, as chipmaking is a hugely energy-intensive industry. However, it also fueled concerns that the manufacturers might be pitting governments against each other in the subsidy race.

Questioned by EURACTIV France about the risks of rising costs, Le Maire stated that the agreement was “final” and included “volume guarantees” on production. He added that looking at these terms, there was no risk for cost rises.

Moreover, “there is a place for everyone on this market”, declared Le Maire, explaining that the French “strengthening of its industrial strategy” was in line with the EU’s.

Chéry explained that “50% of the factory has already been built and 33% has already started production”, emphasising that there will not be cost rises.

He further emphasised that demand for semiconductors in sustainable mobility or renewables was already there and that the factory being built in the town of Crolles, in the Auvergne-Rhône-Alpes region, next to the city of Grenoble, will be able to grasp these opportunities.

Intel raises state aid bar for Germany mega fabs amid subsidy race

Chipmaker Intel wants more than the €6.8 billion promised by Berlin to build two mega fabs- state-of-the-art microchip factories- in Germany, according to media reports.

Expensive industrial strategy

The government aims to ensure “industrial independence”, Le Maire explained, continuing that this is not part of a “decoupling strategy” with China – which “would not make sense and is unattainable”.

He then added that the €2.9 billion subsidy is part of the investment plan “France 2030”, which aims to “bridge the French industrial gap”.

“There is no new expenditure,” he added, referring to the “budgetary discipline” that the French government decided on in order to reduce its debt, which currently sits at 111.6% of the GDP.

The degree to which public spending should finance investment has sparked heated debate in France lately, as credit rating agency Fitch reduced the French rating a month ago. However, the credit rating agency S&P announced on Friday (2 June) that the country would keep its current AA rating.

Read more with EURACTIV